#1.

Complete Review of CheckWriter Software:

CheckWriter Review

Overall Rating:  THE BEST

THE BEST

Features:

Feature packed, and up to date, this software

allows businesses to

take checks

by phone, checks by fax or checks online gets the #1 ranking.

The CheckWriter brand had everything needed to do drafts,

printed checks, facsimile drafts, and even blank checks.

CheckWriter Software has easy monthly billing, batch printing,

invoice options, as well as top check and 3 per page styles.

The import and export were great for web orders from shopping

cart files, and it queues imports for review and batch printing.

The network edition of the software allowed for unique usernames

each with customizable permissions so you could lock out key

functions to other users like print, delete and options menus.

The CheckWriter software also had two customizable fields that

are searchable.

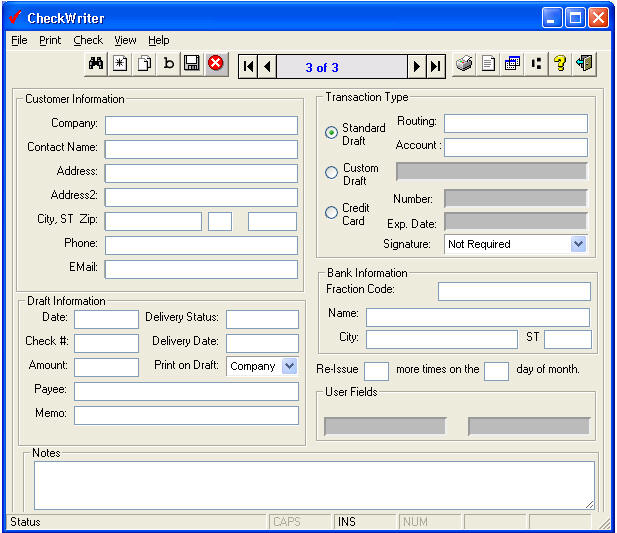

The main screen is easy to use and everything is easy to find,

easy to duplicate and easy to print. A live routing number

database on the toolbar, as well as an automated data backup

feature made the

Ease of Use

Much easier than any other, the CheckWriter user interface is

well thought out and friendly. A quick click toolbar has most

functions available with 1 click. More complex functions

like import are also very easy and obvious. I mapped and

saved my shopping cart text file template and CheckWriter

remembered the file and imported it without error each time.

Customers or past checks can be searched from the main screen,

or from a spreadsheet view which is used for batch printing.

I set up some test monthly billing and processed it very

quickly, doing a cycle of 40 people on a monthly plan.

How It Works at the Bank

The company claims the checks and drafts are Check 21

compliant, so I ran them through my desktop deposit scanner,

deposited them into an auto scan ATM machine and brought them to

the window and in all cases the items were accepted, validated

and credited to my account.

Installation Ease

I installed the software on an XP machine and a Windows

7 64bit PC and both were easy and error free. I purchased the

"Duplex Edition" to evaluate which is for 2 users, one

administrator and one customizable end user. the users and

permissions were very easy to set up. I linked the software

through my network after a call to their support department.

Help and Support

Called support to get help linking the two users to one database

and spoke with someone right away without holding. It turned out

to be a permissions issue and I needed to grant permission

through Windows. This was free because it was within the first

30 days - after that they have free online support or

pay-per-issue support that is $19.99 flat rate.

The Full Picture

CheckWriter software gets top ratings from this reviewer.

The single user version is $129.99. The version I bought for 2

users was $209 "CheckWriter Duplex". For more users, you

can get other versions that cost up to $1,000.

Aside from being easy to use, the software printed checks and

drafts that were 100% compliant with regulations for

distribution, data security and printing. The support provided

what I needed when I needed it, and the company seems to be on

to of compliance with regular updates and legal distribution.

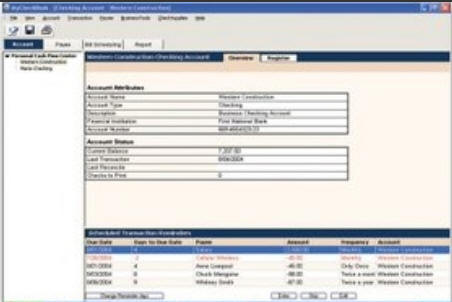

Screen Shot:

Overall Rating:  THE BEST

THE BEST

Other Products not reviewed from the same

publisher:

CheckWriter

Cloud is a cloud based system for

PC or Mac. It is stand alone, but has a monthly fee.

Back to Top

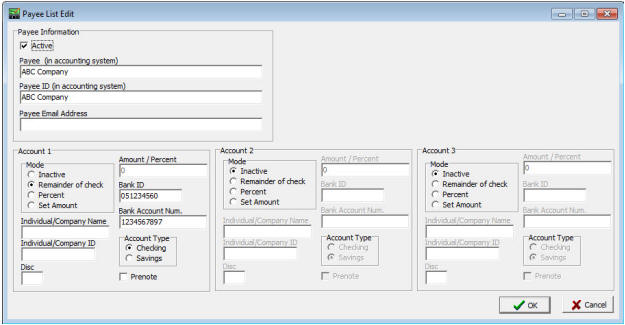

#2.

Complete Review of Quickbooks Pro with PrintBoss

Overall Rating:  VERY GOOD

VERY GOOD

Features:

I have used Quickbooks for many years

and had a love / hate relationship. I have had

colleagues tell me that they use Quickbooks for

everything, including MICR check drafting, so my

first call was to Intuit, the publisher of

Quickbooks, to find out how to make my $250 version

of Quickbooks Pro 2007 print drafts. After only

about 30 seconds holding, they told me I just needed

an add on a plug-in software they sold called

PrintBoss for $149.

Quickbooks and PrintBoss have features galore,

including a full accounting suite that links to all

of your online banking, and prints your tax returns.

It has customer recall, invoicing, payables,

receivables, payroll and with PrintBoss you have the

ability to also do checks by phone, fax or online.

The only feature missing was a viable web form

solution, although you can import a csv from your

own form or shopping cart. PrintBoss also has

so many other features allowing for check alignment,

special printing, payments, multiple payees,

auto-fill, print blank checks, and more. You use the

back up system build in to Quickbooks.

Ease of Use

While feature

packed, it first requires getting into Quickbooks,

then setting up the PrintBoss system to do what you

want to do. While robust, it is not for

beginners, both have a learning curve and do what

they are intended to do without question.

How It Works at the Bank

Intuit has been in this business for years,

and won the 2003 Better Business Bureau Torch Award

for Marketplace Ethics. Because Quickbooks is sold

at retail stores, they require authentication to

order PrintBoss and follow all marketplace

guidelines. The software is constantly updated

to comply with new rules and regulations. I used

these drafts in desktop deposit, the self scan ATM

and at the teller in the business express line and

they were treated like normal checks.

Installation Ease

Because

Quickbooks is a full accounting suite and a plug in,

it takes up tons of space on an XP machine, you

should have about 500MB of hard drive space just for

this application. Installation was easy, but

took a long time on my XP machine, but not as long

on my Windows 7 PC.

Help and Support

Intuit has fantastic support for their product when

it is still in fashion. They were right there to

tell me about PrintBoss, but also reminded me that

they no longer support the 2007 version [5 years

old] and I should consider the upgrade for $200 to

get support. I was able to get PrintBoss to

work with my old version without support.

The Full Picture

QuickBooks is a great

accounting package and adding PrintBoss will allow

you to take checks by phone, checks by fax or online

and keep customer records stored on file for monthly

billing and invoicing. I found that because I

don't use Quickbooks for customer data storage

normally, and I use it for accounting, it mixed up

my records. To get a second copy of QuickBooks to

dedicate to check by phone, Intuit would charge

another $249 or offer a two user version $399 and

the three user version is $649.

Screen Shot:

Overall Rating

for QuickBooks with PrintBoss:  VERY GOOD

VERY GOOD

Back to Top

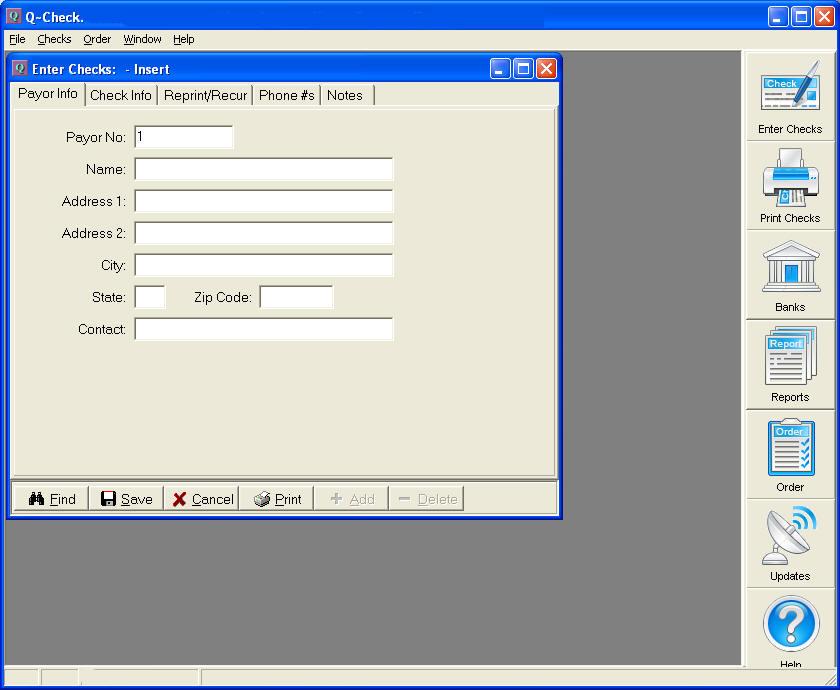

#3. Complete Review of Q-Check

software [aka officepro.com review]

Overall Rating

for

Q-Check:  GOOD

GOOD

Features:

This software was quite robust and had

most of the features needed to take checks by phone,

fax or online. It imported with no problem, had

password protect security, recurring billing, easy

duplicating and an a setup that was simple to

navigate and set up. Pay To names need to be

set up in advance and must be a business name.

Ease of Use

With a few clicks,

I was able to print a draft just by entering the

customer information. The program insisted on

auto-filling the bank information from an outdated

and preloaded database that came with the software.

There is a way to update the bank database through

the company using a link in the software. The

item I printed looked fine but didn't work in the

check scanner.

How It Works at the Bank

At the bank, I had no problems depositing

these drafts. The self scan ATM machine took the

item but could not recognize the amount. I typed in

the amount manually and it accepted the deposit.

Using the desktop deposit scanner, I did not have

any luck. For some reason, it would not recognize

the item at a valid deposit at all giving me an,

"invalid item, amount does not match," error on each

attempt.

Installation Ease

No problems

with installation at all. A special registration was

required, but until purchase it is possible to just

click around the registration screen and use the

software.

Help and Support

Intu

The Full Picture

Not a bad application. Updated just last

year, it is easy to install and use. The

drawbacks are the annual fees, and the fact that the

software does not comply with Check 21 regulations,

or KYC regulations, making the company venerable to

Federal Trade Commission action like

VersaCheck had this year. I was a bit confused

when I came across the software, as the name

"Q-Check" appears to capitalize on the infamous "Q-Chex"

- a company shut down by the

FTC in 2006 for allowing users unrestricted

access to the system which in turn created an

environment for rampant fraud.

Just based on the fact that the software is not

fully compliant with current regulations, and didn't

work with desktop deposit, I had to take off major

marks for this software. The other drawbacks

were the annual fees.

Screen Shot:

Overall Rating

for

Q-Check:  GOOD

GOOD

Back to Top

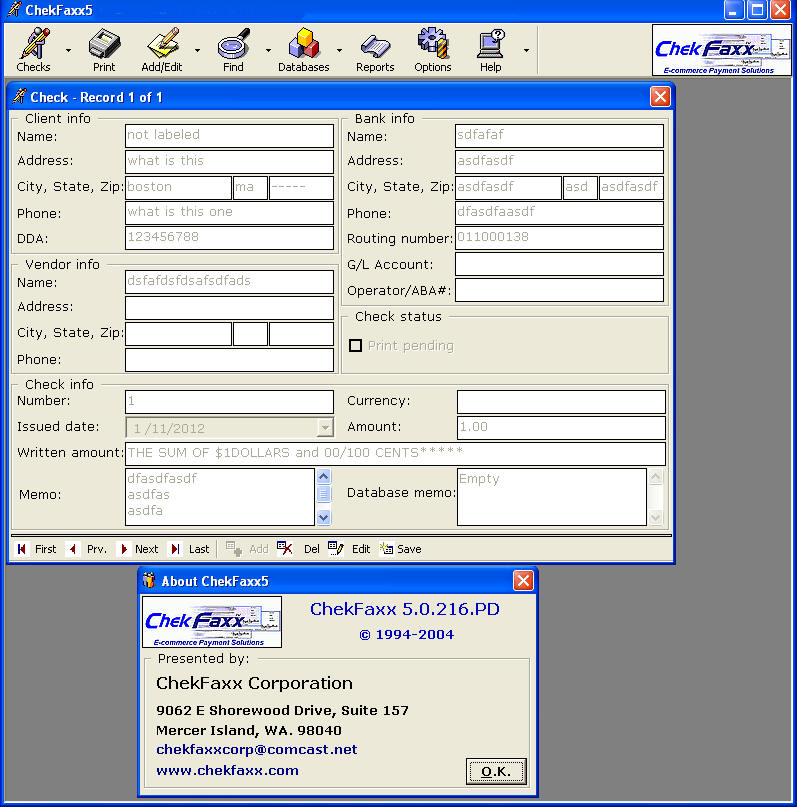

#4. Complete Review of ChekFaxx

Software. ChekFaxx Software Review.

Overall Rating

for ChekFaxx

FAIR

FAIRFeatures:

ChekFaxx was very clumsy, although it

seemed to have all of the major features hidden

around. There are separate menus for each

function. There is a checks menu, a schedule

button on the checks menu, a separate print menu, a

separate finder, and a separate report generator.

The add/edit has 4 separate menus for bank records,

clients, checks and vendors which are all stored in

different databases or lists. The bank database is a

blank database created by ChekFaxx that you can fill

up with bank data that will auto populate if you use

that same routing number again.

Ease of Use

This was not very

hard to figure out, but using it was laborious. The

multiple menus that go to different screens were

cumbersome and when one menu was up, you couldn't

pull up another one because it loced the screen to

that function. I was able to produce check

drafts, but they didn't work very well - most likely

because the last update on this software was in

2004.

How It Works at the Bank

The drafts that I printed did not work with

my desktop deposit, and it did not work at the

auto-scan "no envelope" ATM either. I enclosed

one test as a deposit into my business account from

my personal account and my bank teller took it and

manually entered it in. When it came back in

my statement it was jacketed, so the item had to be

altered and manually processed before clearing.

Installation Ease

I downloaded

a fully working version with no identity

verification as required under current KYC

regulations. It installed with no issu on my XP

machine but did not work on my Vista or Windows 7 PC

Help and Support

I called

ChekFaxx support a few times to see if I could get

an updated version, etc but only received a voice

mail message asking me to leave my details and I

would receive a call back within one business day.

I did not test the response time promise.

The Full Picture

ChekFaxx software is heavily promoted

online, but has not been updated in over 8

years. ChekFaxx does not comply with current

standards for printing a valid Check 21 compliant

check or draft. The software does not work on

Windows 7 and on XP it is clumsy and cumbersome. The

software is marketed contrary to new FTC rulings

about distributing working check drafting software

freely via download without any identity

verification. To top of the mediocre performance of

this outdated software, the price is one of the

highest.

Screen Shot:

Overall Rating

for ChekFaxx

FAIR

FAIR

Back to Top

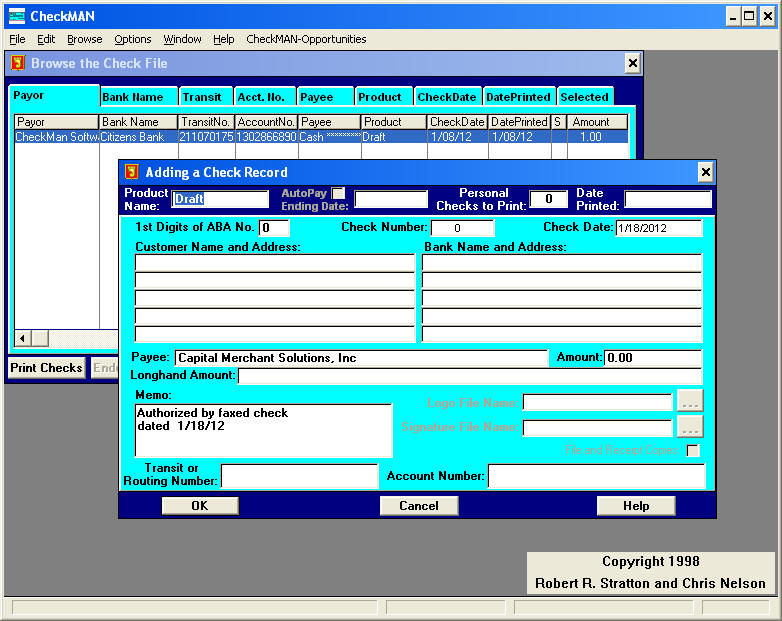

#5. Complete Review of CheckMan

Software. CheckMan Review.

Overall Rating

for CheckMan

POOR

POOR

Features:

CheckMan is over 14 years without an

update, and the software has very limited features.

While the website is newly designed for 2012, the

software is reminiscent of Windows 95 software with

its bright teal database tabs and backgrounds. It

has one option called file fixer that will fix your

database file if it gets tangled up. It will

produce a draft of a check or a check and allows you

to add a logo, but will not print an item that is

Check21 compliant.

Ease of Use

The software

installed on my Windows XP but not on my Windows 7

and I was able to use it right away. There was

documentation about every function.

How It Works at the Bank

The drafts that I printed did not work with

my desktop deposit, and it did not work at the

auto-scan "no envelope" ATM either. I enclosed

one test as a deposit into my business account from

my personal account and my bank teller took it and

manually entered it in. When it came back in

my statement it was jacketed, so the item had to be

altered and manually processed before clearing.

Installation Ease

I downloaded

a fully working version with no identity

verification as required under current KYC

regulations. It installed with no issue on my XP

machine but did not work on my Windows 7 PC. It had

no errors or issues and took only about 2 minutes to

have up and running.

Help and Support

Their support

is open 10-6 M-F. I did not use the email based

support so I cannot rate it.

The Full Picture

CheckMan software is promoted by Capital

Bank Drafts online through a newly designed website

for 2012, but the software being distributed by them

is 14 years old and copyright 1998. The reality of

CheckMan Software is that for the $129 to $949 you

spend, you get software that won't work with desktop

deposit or new ATMs, it won't work with Windows 7

and could come off the market because they make a

fully working downloadable demo available without

any authentication at their site.

CheckMan is mediocre performance from a dinosaur for

a premium price. This reviewer's advice is steer

clear of this one.

Screen Shot

Back to Top

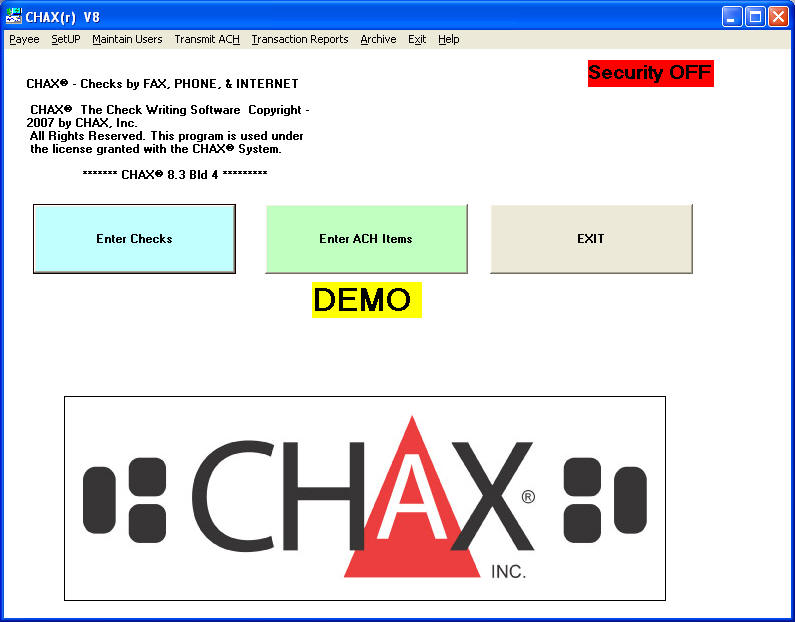

#6. Complete Review of Chax

Software. Chax Review.

Overall Rating

for Chax

POOR

POOR

Features:

Chax from 2007 had scattered teal

colored menus that allowed for the creation of a

draft, saved transactions and batch printing. It was

a bit clumsy, but to the point and easy enough to

figure out. The drafts were not Check 21 compliant.

It lacks an import and proper monthly billing

features as well as invoice printing. The software

won't automatically store data, you must specify to

'save' the information to keep it.

Ease of Use

Chax software was

simple to use. It was good for checks by phone or

checks by fax but had no import interface in the

version I had. Once I entered in a few test items I

printed them without issue in a batch.

How It Works at the Bank

The drafts I printed did not work with my

desktop deposit, even with MICR toner, but I did get

one to go into the auto-scan envelope free ATM. The

teller also took my item for deposit but it was

manually processed and a strip was applied to

correct the MICR on the low check number I used.

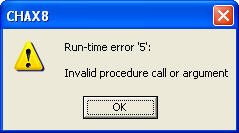

Installation Ease

I did not

have installation issues, and the software did work

on my XP and Windows 7, but I had errors after using

the software where it produced Run-Time error 5.

When evaluating these programs, I

made up tons of drafts from one Citizens Bank

account to deposit into a Bank of America account.

I used low check numbers to identify each, much like

if it was for a monthly billing cycle. If I

use a check number like 0012, it would remove the

leading 0 and print |"12|" rather than |"0012|"

Because this wouldn't work with the desktop deposit,

I tried 0000 and it won't allow it.

When I tried to use a short account number from a

very old checking account, the program produced

errors and quit.

Help and Support

Their 11 a.m.

to 8 p.m. telephone support hours of operation were

a bit annoying, but they are located on the west

coast and run on a west coast schedule. They did

answer and told me that I could avoid the error by

entering a valid account number and valid check

number. They made it out like the error was

designed into the software to alert me I was

entering invalid data. Of course the data is

what I wanted to enter.

The Full Picture

For $199 plus $150 per additional PC you get

a clumsy product that has not been updated in 5

years. Chax produces software errors, lacks

sophisticated features, and produces drafts that are

not Check 21 compliant. Even though Chax installs on

Windows 7, the drafts still need to be manually

processed and jacketed by the receiving bank.

Because the items don't work properly with the bank,

and it produces errors, this software gets poor

ratings.

Screen Shot

Overall Rating

for Chax

POOR

POOR

Back to Top

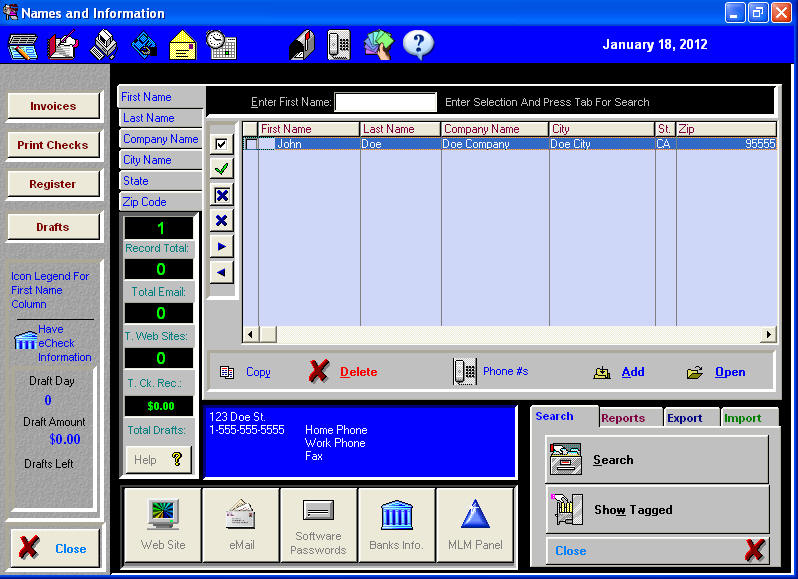

#7.

Complete Review of Checkmatic

Software. CheckMatic Review.

phonechex.com officepro.com

Overall Rating

for Checkmatic

POOR

POOR

Features:

CheckMatic software

had all kinds of bells and whistles that you would

want in the 1990s like an area code directory and

Multi Level Marketing "MLM Panel". It also has

import and export, checks and drafts, batch

printing, bank data storage, and quite a few of the

more useful features you would expect from one of

the better products.

Ease of Use

The CheckMatic was

quirky but easy to use. It had crazy background

pictures on the main menu, but I was able to enter

checks and drafts with ease and print them out

without even looking at the manual or talking to the

technical support. I thought it was user friendly,

but the items I tested did not work with the self

scan ATMs and did not work with desktop deposit.

Come on guys, Check 21 has been around for a long

time. I brought my drafts, rejected from my desktop

deposit application and from the ATM over to the

teller, and my bank jacketed them with no fees, and

credited them to my balance without issue. The

items were returned paid and jacketed, then

converted to images when they appeared back in my

statement.

How It Works at the Bank

The checks and drafts that CheckMatic print

are not Check 21 compliant or ANSII compliant. They

don't work with desktop deposit and don't work in

the envelope free ATM machines. Because the

bank manually processes them, many banks will likely

just refuse them entirely.

Installation Ease

I downloaded

the CheckMatic Business Professional Edition with no

ID and within 10 minutes I was printing checks and

drafts. The menus and functions are numerous and

scattered, but easy enough to find. If the

software produced legal items for deposit, it may

get higher rankings.

Help and Support

Their phone

support was available and answered the phone

starting at 10 a.m. on the day I installed the

software.

The Full Picture

CheckMatic is marketed online at

phonechex.com and officepro.com. The software was

written in 2001 and while the websites claim a 2012

copyright, the content has not been updated for over

5 years. When I went to order my copy, the site was

running a special that expired in 2007.

The software itself is outdated and clumsy and the

drafts CheckMatic prints do not work with the

current banking system unless they are manually

processed and jacketed or striped by the bank.

At $169 this software will do nothing but get you

into trouble with your bank eventually and it would

be best to steer clear of CheckMatic.

Screen Shot

Overall Rating

for Checkmatic

POOR

POOR

Back to Top

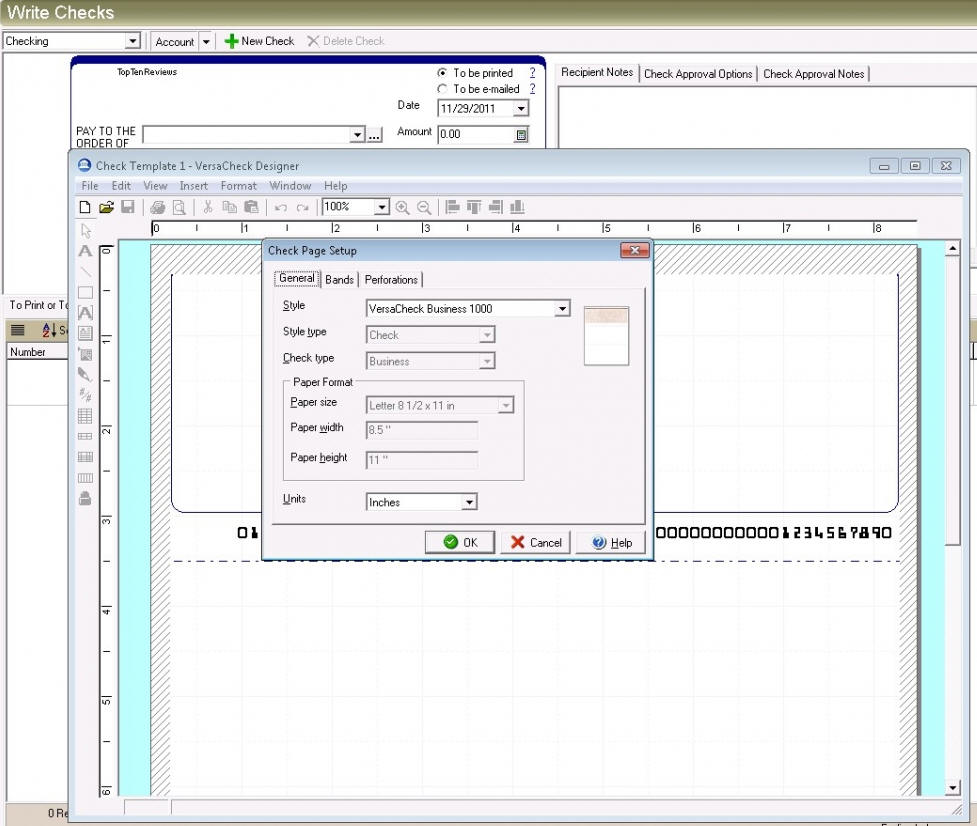

#8. Complete Review of Versa

Check Software: VersaCheck Review

Overall Rating

for

VersaCheck

POOR

POOR

Features:

VersaCheck software

has tons of features, and it is easy to use, install

and understand. The publisher updates the software

constantly and the checks adn drafts are all Check

21 compliant.

Unfortunately, to use VersaCheck for checks by

phone, checks by fax or taking online checks, you

must have the customer participate in a one time

verification that the merchant pays for using a

third party verification service called 'gValidate'.

This basically makes the software impractical

to use as a payment system because at the end

of 2011 a ruling by the Federal Trade Commission

threatened to shut down VersaCheck if it did not

comply. Until this happened, VersaCheck always

received good reviews.

To

comply with this FTC ruling, VersaCheck now makes

all businesses that buy VersaCheck "gValidate" their

clients before a check by phone, fax or internet can

be drafted. This means before you can take a

payment from the customer, you must get gValidate to

make a small deposit of a few cents in the

customer's account - then the customer must provide

the amount of this deposit to the VersaCheck owner

to complete the validation. Only after this

back and forth process can a draft be produced.

The fees paid by the merchant.

Ease of Use

The software itself

is easy to use, but due to the FTC lawsuit against

this company, the software is now impractical to

use. Any other check by phone software can be

used without involving a third party. Using the

software for phone orders, collections, mortgage

payments, insurance and other industries, this

system would be too slow and difficult for the

consumer and is a technical support nightmare.

How It Works at the Bank

The banks are returning all items generated

from old versions of VersaCheck. They will

only take items that have the gValidate approval in

most cases. The items all worked with my desktop

despot, with the auto-scan ATM and when I brought

them to the bank after I gValidated my own account.

Installation Ease

I did install

VersaCheck with no problem on my XP and Windows 7

PCs without a problem. No errors no hassles.

Help and Support

Their support

was not very friendly and even though they don't

advertise that you are REQUIRED to gValidate

customers when you buy the software, they will give

you a refund if you ask for it.

The Full Picture

VersaCheck was one of the heavy hitters in

the check by phone business, but unlike its

shelf-mate Quickbooks whose publisher won the BBB

Torch Award for industry standards and compliance,

the publishers of VersaCheck have an "F" rating with

the BBB and the company has been in hot water before

with a long history of shady behavior. According to

the Federal Trade Commission's lawsuit, the

publisher distributed VersaCheck illegally at

Staples, Office Max and other consumer outlet stores

where anyone could buy the software anonymously,

thereby making it a prime tool of choice for

fraudsters, money laundering operations, and even

organized crime. Not a good match for business

payment software in this reviewer's opinion.

Screen Shot

Overall Rating

for

VersaCheck

POOR

POOR

Back to Top

#9. Complete Review of Checksoft

Software: CheckSoft Review

Overall Rating

for CheckSoft  POOR

POOR

Features:

CheckSoft is

designed to organize finances, and allow the end

user to design custom business checks to be printed

with MICR toner. The software will do the MICR

printing needed to take checks by phone and fax,

then create a draft for deposit, but it is very

poorly designed. It has the ability to print

business and personal checks, payroll checks and to

create custom checks with logos and designs. It

claims to work with Quicken and Quickbooks but did

not work with mine. It does have reporting,

and an import feature that work well. It does

not do monthly billing or manage your customer

payments.

Ease of Use

The software is not

easy to use. As it is sold retail there are tons of

other online reviews of this software. It was

not just me, it was apparently everyone who ever

purchased this product, then returned it to Staples

or Office Max. Many of the functions like linking

with Quickbooks do not work and the check design

features are laborious. It is not good to use for

payment software, or for check design software.

How It Works at the Bank

The checks and drafts that this software can

eventually produce work with desktop deposit, the

self scan "no envelope" ATMs and for deposit with

the bank teller without jacketing manual entry.

The one thing the software does do is print Check 21

compliant and ANSII conforming items.

Installation Ease

I did not

have an issue with my XP machine and the software

installed without any problems. It is not

designed for Windows 7 as of the purchase I made on

January 3, 2012.

Help and Support

Their support

is 11 a.m. to 9 p.m. eastern time I found out from

the publisher's site, but if you call it just keeps

telling you you are calling outside of regular

hours.

The Full Picture

I reviewed this software because it was on

the shelf at Staples next to VersaCheck and was

available online everywhere I looked. Also

available online, unlike most of the other products

reviewed here, are tons of other reviews that

overwhelming support my own rating of "TERRIBLE".

Screen Shot

Overall Rating

for CheckSoft  POOR

POOR

Back to Top

#10. Complete Review of My Software:

My Software Review

Overall Rating

for My Software  POOR

POOR

Features:

This software has very few

features and is no longer published. Until 1999 this

software was sold in boxes at retail stores. In 1999

it was pulled from the shelves and rather than

destroying the stock, it was sold to liquidators who

reintroduced the outdated software online in 2002

though vendors like Amazon.com. It only works on

Windows 95 and 98 and won't work on XP, Vista or

Windows 7.

Ease of Use

This

software is impossible to use if you have Windows XP

or better. I was unable to get it to install at all.

How It Works at the Bank

The software was made before Check 21

regulations and does not comply with modern check

printing standards. No banks will accept these

Installation Ease

I did not get

this software to install at all.

Help and Support

Their support

is gone and the company is closed. This is just an

old software package dumped on amazon.com and other

sites and is useless.

The Full Picture

Basically, as noted above and in

these public reviews, this software is totally

useless. It is available everywhere when you

search for check by phone software but it won't

actually work. I rated this one the worst,

although I only wasted $19 on it.

Screen Shot

NONE - COULD NOT GET INSTALLED ON

PC

Back to Top

---------------------------------------------------

Compare with other brands of checks by phone software.

------------------------------------------------------------------------------------------

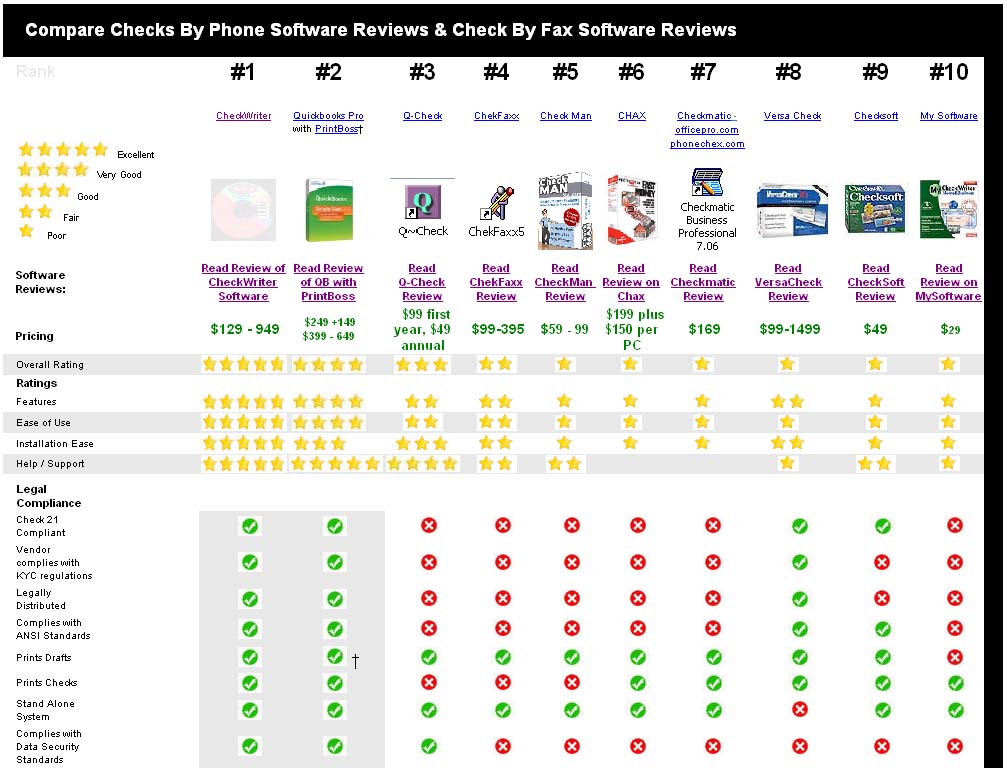

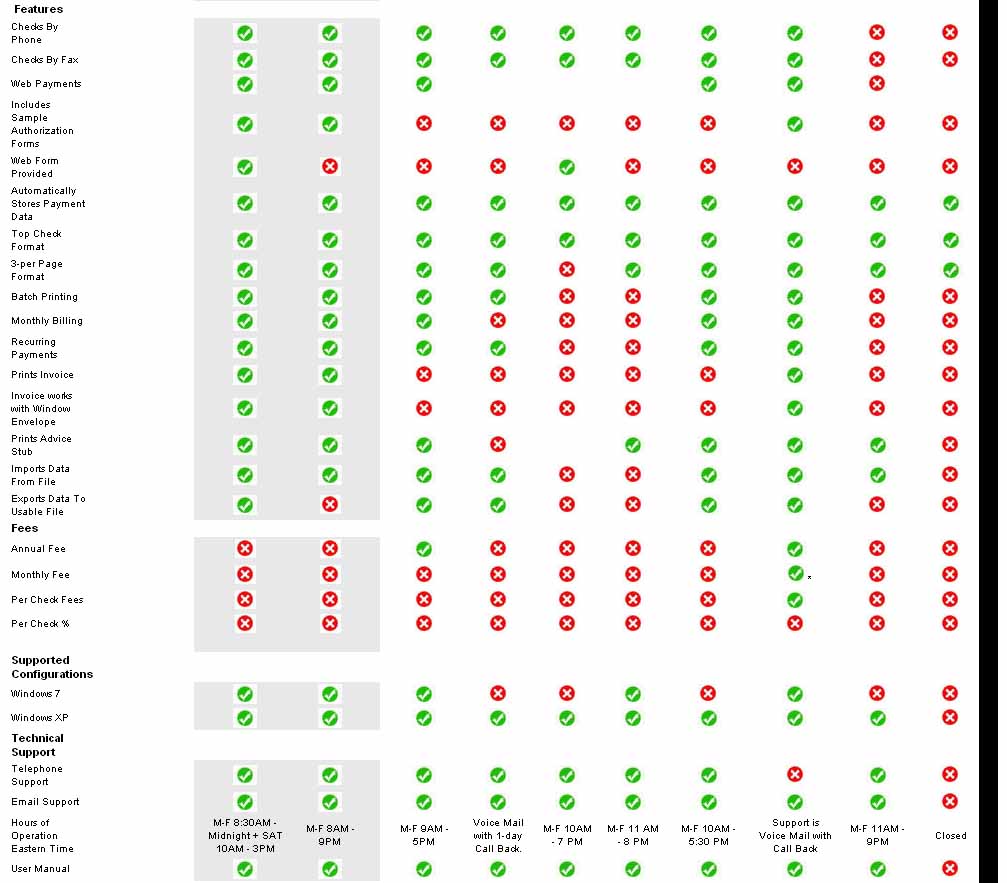

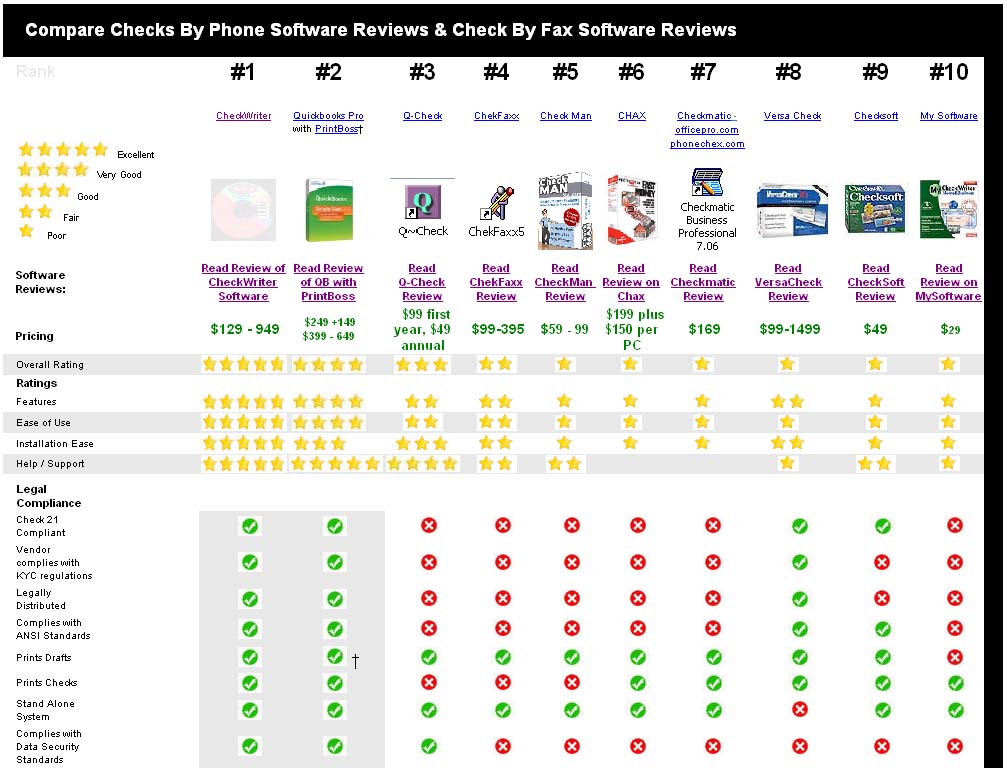

Overall Rating

The overall rating combines the features, ease

of use, installation ease and support and rates the

10 most popular checks by phone, checks by fax and

online check drafting software packages and

programs.

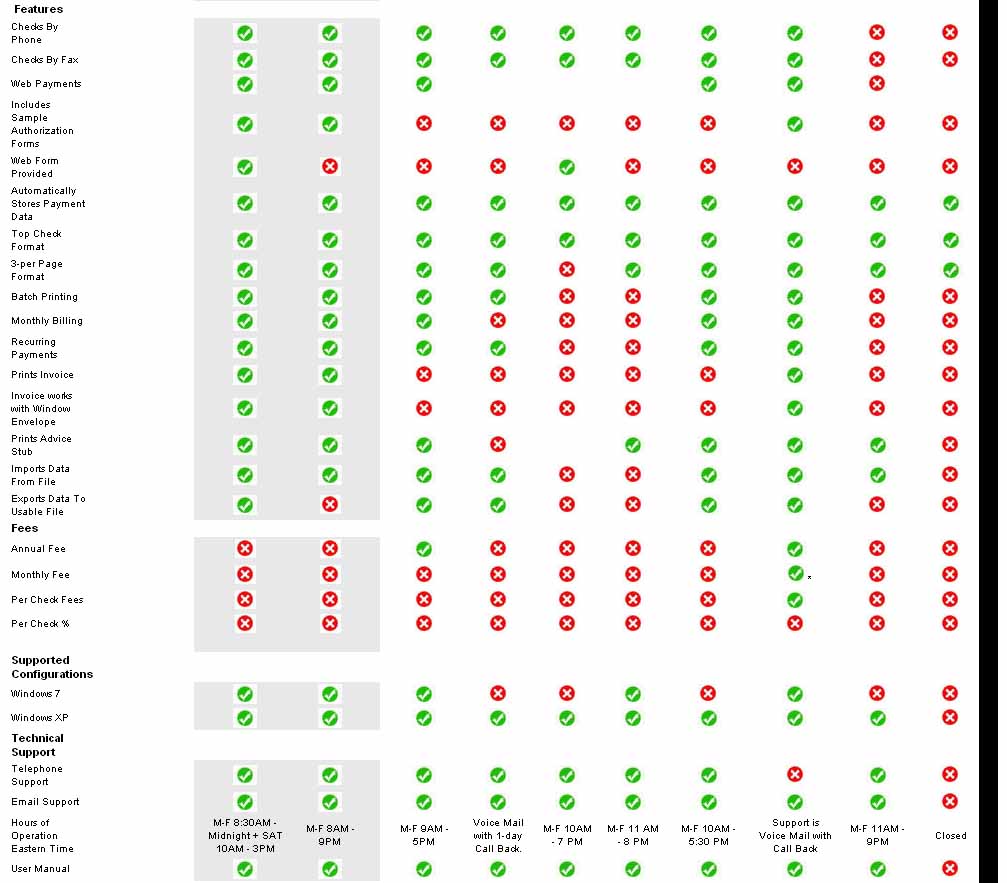

Features

Top

The features are detailed below - the feature star

rating is based on the combination of the individual

features for each of the software products.

Ease of Use

Top

Ease of star rating is based on the actual user

experience and how easy the software really was to

use. Not just how easy was it to figure out, but how

easy was it to use on a daily basis for multiple

payment situations.

Installation Ease

Top

This is how easy it was to get the software

installed - from dropping in the disk, to opening

the software for the first time.

Help / Support

Top

The support rating is based on the type of support,

the hours they were available, if they actually pick

up the phone, answer their email and if they are

helpful when they do.

Legal Compliance

Check 21 Compliant

Top

This is basically yes or no. If the drafts the

software prints are Check 21 compliant and work with

desktop deposit and remote deposit capture (RDC) and

if they work with the automatic scan ATM machines

with no envelope required.

Vendor complies with KYC regulations

Top

Because this software is payment software, and can

facilitate funds transfer, the sellers or publishers

must follow proper KYC guidelines requiring all

purveyors of such software to know their customers

and follow formal and complete process to verify

that the end user will be a business and that the

software is not sold or distributed outside of U.S.

software export law requirements. Vendors that

provide free, working downloadable copies of the

software on a trial basis have already been ruled by

the Federal Trade Commission to be unlawfully

distributed.

Why would you care if the company you buy your

software from complies with this regulation?

Basically, companies that do not comply with

distribution regulations propagate fraud. In the

case of Q-Chex and VersaCheck the Federal Trade

Commission came down hard and most of their

customers lost their money. Other companies

that don't follow these rules will eventually be

targets for regulatory agencies and law enforcement,

making them less reliable.

Legally Distributed

Top

Is the software distributed according to current

guidelines for KYC? Software made available for

download without authentication of the end user is

not legally distributed. Software distributed for

download to know IP addresses belonging to countries

where the U.S. has trade embargos is also illegal.

Complies with ANSI Standards

Top

Does the finished draft comply with the standards

and regulations of the American National Standards

Institute (ANSI).

Prints Drafts

Top

Will the software print check drafts with no

signature required.

Prints Checks

Top

Will the software print checks that can be signed by

the account holder and used as a negotiable

instrument?

Stand Alone System

Top

Is this a stand alone system, meaning not a virtual

terminal or service that runs through a third party.

Stand alone systems reside on your local PC and the

customer's account information never passes to a

third party. In a stand alone system, the funds are

never handled by a third party, only by the end

user.

Complies with Data Security Standards

Top

Arizona and Massachusetts have the strictest

security standards and require any confidential

customer data to be password protected with a secure

password that is at least 7 characters and

alpha-numeric. If the software allows for such

protection it is considered compliant with current

data security standards.

Features

Checks By Phone

Top

Will the software accommodate checks by phone?

Checks By Fax

Top

Will the software accommodate checks by fax?

Web Payments

Top

Will the software accommodate Internet orders,

shopping carts, web order forms?

Includes Sample Authorization Forms

Top

Does the software have a document center or

downloadable forms that can be used customized and

authorization of payment?

Web Form Provided

Top

Is a web order form or template included?

Automatically Stores Payment Data

Top

Does the software automatically store the customer's

information or is it a manual process every time?

Top Check Format

Top

Does it print on standard business size TOP CHECK

blank check stock?

3-per Page Format

Top

Does it print on standard business size 3 PER PAGE

blank check stock?

Batch Printing

Top

Will the software do batch printing? This is when

you run a print job of multiple payments at one time

in a group, rather than one by one.

Monthly Billing

Top

Will the software allow you to set up, or does it

have directions on how to set up, monthly billing

where a customer pays monthly on one particular day

of the month for a specified number of months or

indefinitely.

Recurring Payments

Top

Does the software allow the user to set up recurring

payments.

Prints Invoice

Top

Does the software print a valid invoice that can be

sent to the customer to comply with some outbound

telemarketing requirements for checks by phone

payments.

Invoice works with Window Envelope

Top

Does the software print an invoice that can be

folded and dropped into a window envelope?

Prints Advice Stub

Top

If the software prints top check, does it print an

advice stub that can be mailed to the accountholder

to comply with some outbound telemarketing

situations.

Imports Data From File

Top

Will the software import a file from CSV, TXT, XLS,

MDB etc.?

Exports Data To Usable File

Top

Will the software export to a standard format,

non-proprietary file format?

Fees

Top

Are there any ongoing fees vs. one-time purchase

Annual Fee

Top

Is there an annual fee?

Monthly Fee

Top

Is there a monthly fee?

Per Check Fees

Top

Are the per check charges?

Per Check %

Top

Is there a percentage charge or discount rate?

Supported

Configurations

Windows 7

Top

Does the software install on Windows 7?

Windows XP

Top

Does the software work with Windows XP?

Technical Support

Telephone Support

Top

Does the company offer telephone support?

Email Support

Top

Does the company offer email support?

Hours of Operation Eastern Time

Top

What are the company's hours of operation?

User Manual

Top

Is there a user manual? Help?

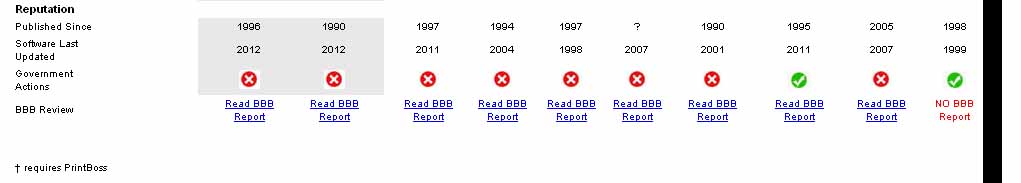

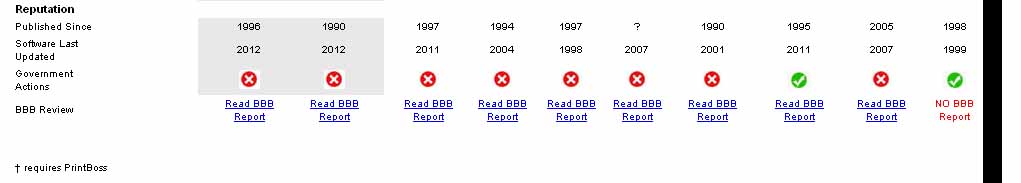

Reputation

Published Since

Top

When was this software first published.

Software Last Updated

Top

When was the last time the company updated the

software?

Government Actions

Top

Are there any pending suits against the company

or government actions from the Federal Trade

Commission, the Federal Reserve or other regulatory

agency?

BBB Review

Top

A direct link to the BBB report on the software

publisher.

Date this review was

updated: November 8, 2012

Back to Top|

1

| 2 | 3 |

4 | 5 |

6 | 7 |

8 | 9 |

10 | Compare All

|

Site Map

|